In today’s complex business environment, companies invest millions of dollars in property, buildings, machinery, and equipment and these assets aren’t just line items on a balance sheet.

They generate revenue, support operations, and, if poorly managed, can drain cash through reactive maintenance and hidden costs.

This is where NetSuite asset management becomes critical. By providing a unified platform to track assets throughout their lifecycle and tie maintenance activities directly to financial data, NetSuite helps businesses control costs, make smarter decisions, and improve long-term asset performance.

According to reliable market research, the global enterprise asset management (EAM) market which includes advanced asset and maintenance tracking software was valued at over USD 5.1 billion in 2024 and is expected to more than double by 2034, growing at a 10.4 % CAGR.

What NetSuite Asset Management Means For Property Assets

The Basics Of Asset Tracking

At its core, asset management involves recording and monitoring a company’s long-term property and equipment from acquisition through depreciation and eventual disposal.

This process is integrated with financials, maintenance scheduling, and reporting unlike traditional spreadsheets that are prone to errors, redundant entries, and loss of historical data.

Why Fixed Asset Visibility Matters

Property assets like buildings, vehicles, and production equipment often make up a significant portion of a company’s capital investment.

According to accounting standards, these fixed assets require continuous tracking to ensure the company complies with regulations and accurately reports their value.

More importantly, visibility enables businesses to:

- Avoid duplicate purchases

- Track location and utilization

- Log maintenance and repair history

- Generate audit-ready reports

All of which contribute to more effective financial planning and operational control.

With a solid understanding of why this matters, let’s explore how NetSuite’s asset management features make all this actionable.

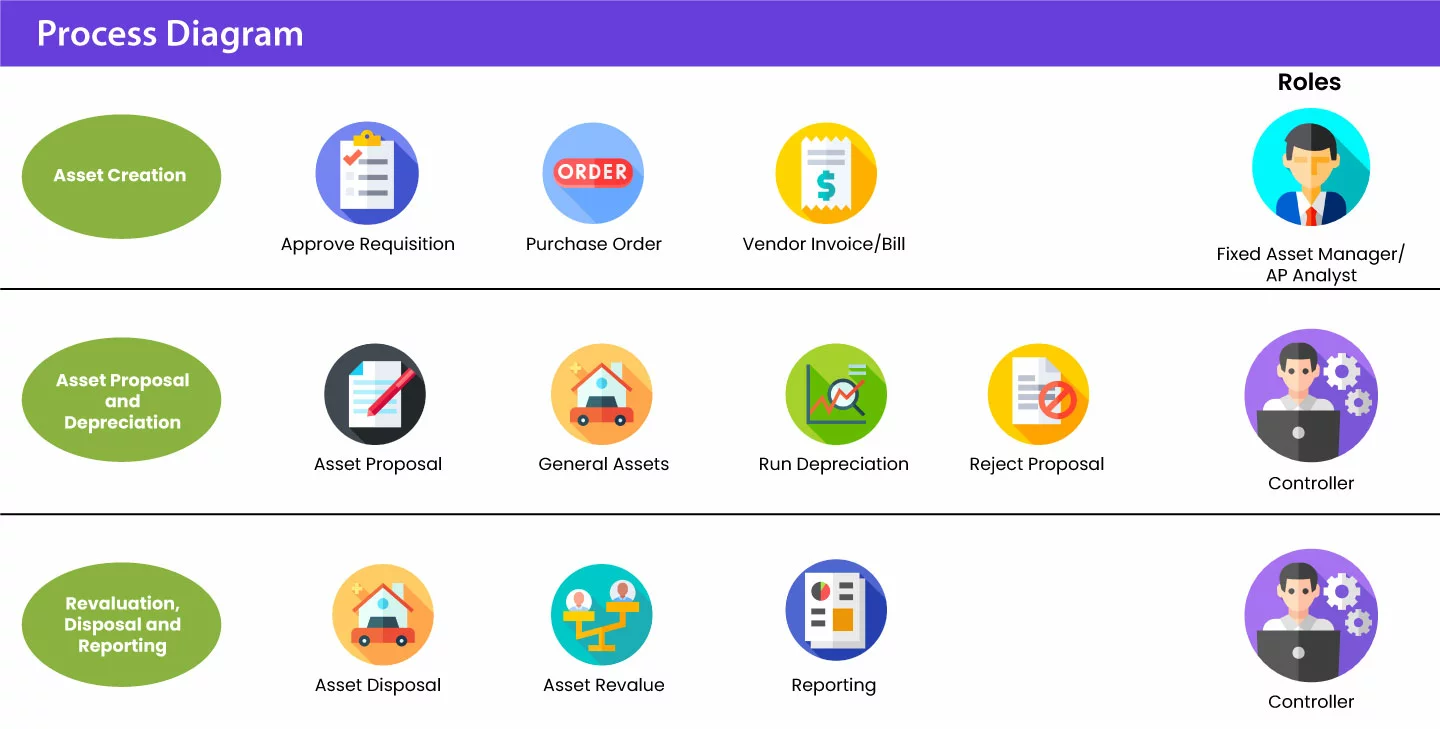

How NetSuite Asset Management Works

Unified Asset Database

One of the biggest advantages of NetSuite asset management is its ability to maintain a centralized register of all property assets, eliminating confusion from multiple tracking systems.

This means every asset whether a warehouse forklift or a regional office building has a captured history that includes purchase cost, depreciation, and maintenance activities.

Automated Lifecycle Tracking

NetSuite tracks properties from acquisition to retirement.

By automating depreciation schedules, handling lease accounting, and maintaining a full asset history, it eliminates manual work and the risk of human error.

Real-Time Reporting And Dashboards

Instead of waiting for monthly or quarterly printouts, NetSuite provides real-time dashboards to monitor asset value, maintenance costs, utilization, and depreciation.

These insights help businesses respond quickly to issues and plan more effectively.

Now that we know what NetSuite does, how does this translate into real financial benefits especially in long-term maintenance?

Reducing Long-Term Maintenance Costs With NetSuite

Proactive Rather Than Reactive Maintenance

Traditional asset tracking often leads to reactive repair, fixing what’s broken rather than preventing breakdowns.

With proactive scheduling driven by built-in metrics and alerts, maintenance teams can perform preventive actions before failures occur, reducing costly downtime and emergency repairs.

Market research suggests that organizations implementing enterprise asset management solutions can reduce maintenance costs by 15 – 28% and unplanned downtime by 23 – 37%.

Comprehensive Maintenance Records

NetSuite logs all maintenance work performed on each asset.

This historical data helps determine patterns, for example, whether certain assets require service more often than expected, enabling smarter budgeting and longer equipment life.

Maintenance Cost Forecasting

By combining historical maintenance data with usage trends,

NetSuite’s analytics help predict future maintenance needs, allowing companies to allocate budgets accurately and avoid surprise costs.

Saved downtime and controlled maintenance costs don’t just free up cash, they improve operational performance across departments.

Improving Asset Utilization And Value

Extended Asset Lifespan

Good maintenance increases the useful life of assets.

With NetSuite, companies can track a maintenance schedule that aligns with manufacturer recommendations and internal thresholds, improving longevity and deferring costly replacements.

Optimal Resource Deployment

Real-time visibility lets operations teams understand which assets are underused and which are overburdened.

By balancing workloads and relocating assets when necessary, companies get better returns on their investment.

Reducing Ghost Assets

NetSuite helps identify “ghost assets” items that are listed but no longer in use which if left untracked, can lead to unnecessary insurance, tax, and depreciation costs.

Beyond uptime and better utilization, businesses also benefit from improved financial alignment and decision-making.

Financial Benefits And Strategic Planning

Integration With Financial Modules

Unlike standalone tracking tools, NetSuite integrates asset and maintenance data with financial modules, meaning every repair, depreciation entry, or asset disposal automatically updates the general ledger without manual journal entries.

This seamless integration ensures:

- Accurate financial statements

- Timely depreciation reporting

- Better budgeting and forecasting

Total Cost Of Ownership (TCO) Analysis

Understanding the total cost of ownership including purchase price, maintenance, repair, and eventual replacement is essential for property planning.

NetSuite gives finance teams the data they need to calculate TCO accurately and compare scenarios like repair vs replacement.

Audit And Compliance Readiness

Accurate, audit-ready records reduce risk and improve regulatory compliance.

Whether for tax purposes or internal controls, having historic maintenance and valuation data easily accessible adds confidence to audits.

With financial clarity and operational efficiency, the last piece of the puzzle is strategic implementation and adoption.

Best Practices For Implementing NetSuite Asset Management

Clean Asset Data Entry

Successful asset tracking begins with accurate data.

Start with clean, complete records for all assets including cost, location, and expected useful life to ensure NetSuite’s reporting and maintenance alerts work effectively.

Training And Ownership

Maintenance teams need training on how to enter and maintain asset records. This includes understanding maintenance codes, scheduling logic, and how to interpret dashboards.

Leverage Predictive Tools

Where possible, integrate IoT monitoring and predictive maintenance tools with NetSuite. These technologies can flag patterns that indicate potential problems before they occur, further reducing costs and improving uptime.

Conclusion

Effective property asset tracking and maintenance cost management are not luxuries — they are necessities in asset-intensive businesses.

By centralizing data, automating routine tasks, and providing detailed financial insight, netsuite asset management offers a strategic advantage that translates into lower maintenance costs, better resource utilization, and more accurate financial planning.

With proven market growth in asset management solutions and real cost-saving potential, companies that invest in modern asset tracking and maintenance planning like that offered by NetSuite are better positioned to compete, grow, and maximize the value of their assets throughout their lifespan.